Share On Social!

Nearly two-thirds of renters nationwide say they can’t afford to buy a home.

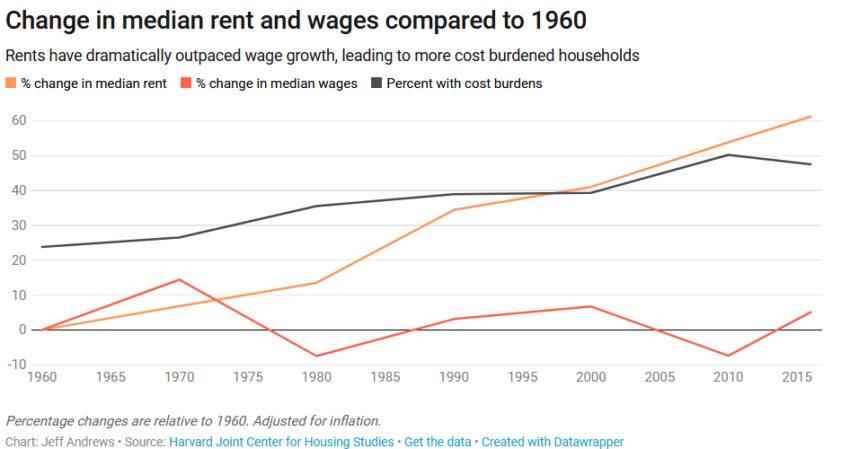

According to ATTOM Data Solutions’ latest Rental Affordability Report, home prices are rising at twice the rate of wage growth.

“With rental affordability outpacing home affordability in the majority of U.S. housing markets, and home prices rising faster than rental rates, the American dream of owning a home, maybe just that — a dream,” ATTOM Data Solutions Director of Content Jennifer von Pohlmann told HousingWire.

April marked the 10th consecutive month with year-over-year declines, according to the report, contributing to a positive outlook for the housing market. Despite a slight uptick in July, last year saw the lowest number of foreclosures since 2005.

Last month, year-over-year rates were in decline for the 10th month in a row. In 2018 the foreclosure incidences were at their lowest since 2005. These factors are giving some experts hope for a healthy housing market going into 2020, according to The Real Deal.

Overall, foreclosure activity in the U.S. has decreased by 13%

“Falling nationwide foreclosure figures have been aided by a strong economy and dwindling mortgage delinquency rates, which hit a 12-year low in 2018,” writes The Real Deal‘s Joe Ward.

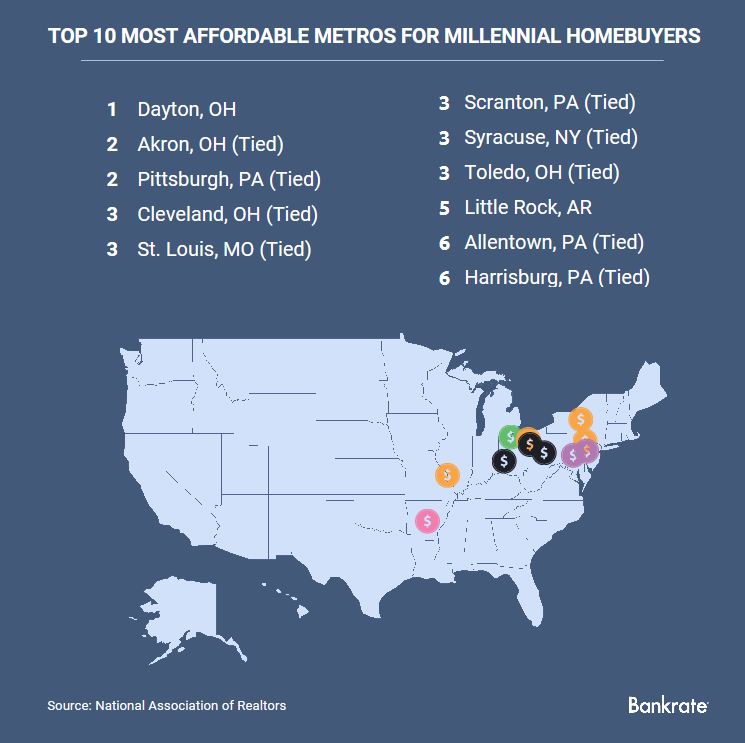

According to Zillow, more millennials are living at home than at any other point this century

Of the cities that topped the list for offering affordable housing prices and has the largest share of millennial movers were:

- Madison, Wisconsin (7% Latino)

- Oklahoma City, Oklahoma (19.1%)

- Omaha, Nebraska (13.7%)

- Grand Rapids, Michigan (15.3%)

New Measures in Housing Access

America has a long history of segregationist, racist housing policies that have created incredible gaps in the affordable housing options, and homeownership access to people of color. This has stifled household wealth creation in communities across the country.

Major cities like Austin (34.5% Latino), San Francisco (15.3%), San Antonio (64%), and many others have changed policies to curb the affordable housing crisis. Moreover, affordable housing and rent control measures were crucial issues in local and state elections during last year’s midterm election.

The Healdsburg, California (33.7%) City Council is acquiring a $5 million apartment complex and ensures the property will remain affordable for low-income tenants. Two months before the city council ruling, multiple Latino families living in low-income housing faced lease terminations

In Aspen, Colorado (8.3%), Aspen Skiing Co. hopes to curb the city’s affordable-housing needs by spending $15 million to build a 148-bedroom project in Willits Town Center.

Affordable housing burdens and Latino families

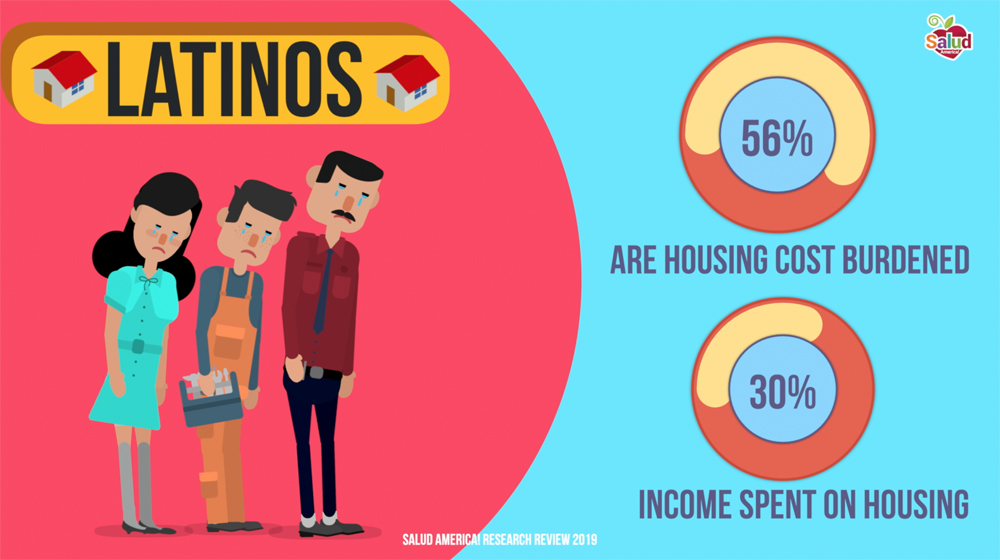

According to recent findings from the National Association of Hispanic Real Estate Professionals, Latinos were the only ethnic group with net growth in U.S homeownership.

Still, several studies also show that Latinos in the U.S. face increasing housing cost burdens.

Despite their outsized role in the market, Latinos experience numerous difficulties in homeownership. Nationwide, a rising number of Latinos are even dealing with the possibilities of eviction.

Cities and community partners are pushing for more affordable housing more and more. They are using tools like eased zoning standards, buying land to give to affordable developers, and setting up available housing trust funds for future projects — all in hopes of curbing housing affordability problems.

Check out more stories on affordable housing:

Learn: Major changes in Affordable Housing!

Explore More:

HousingBy The Numbers

56.9

percent

of Latinos are "housing cost burdened"